Investing is Entertainment and Traders are Celebrities

The American Dream is to get rich *quick*.

Instead of violent wars, there could be violent video games; instead of heroic feats, there could be thrilling amusement park rides; instead of serious thought, there could be ‘intrigues of all sorts’, as in a soap opera. It is a world where people spend their lives amusing themselves to death.

— Peter Thiel, The Straussian Moment

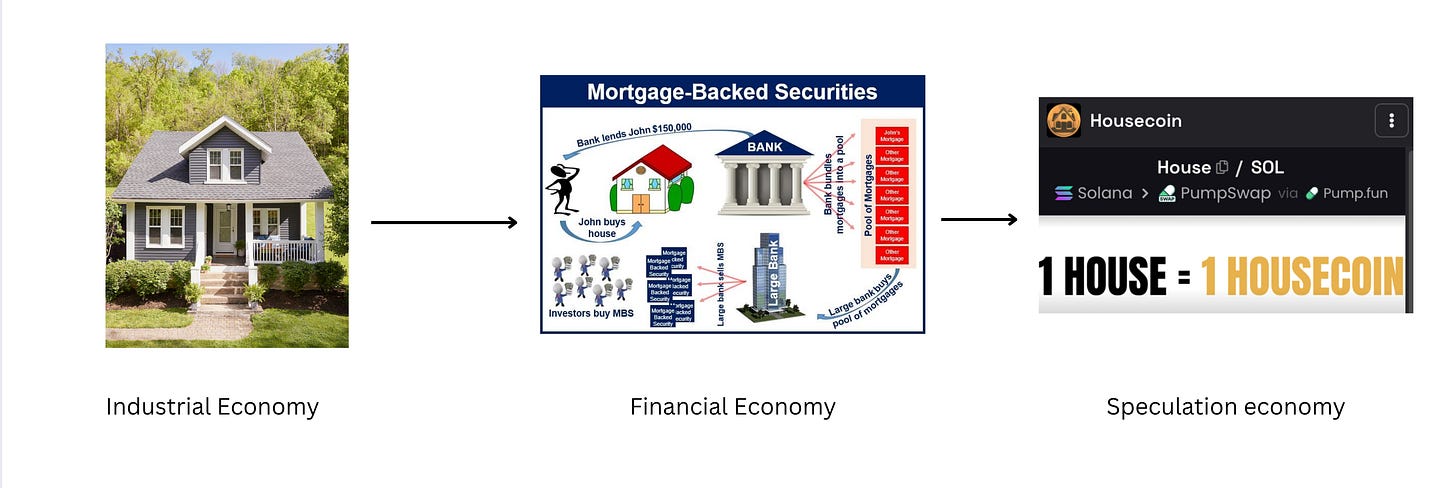

We used to make money by building tangible things like furniture, bicycles, and homes. We then started making money by working for people who built things, as managers, consultants, and investment bankers. Now, we make money by trading things that barely exist: perpetuals, memecoins, and zero day options.

Investing is Entertainment

As a society, we are dried of dopamine. Products with lottery-like payoffs give us another hit.

Investing used to be logging into your Fidelity account to check your 401K returns. The new investor class trades perpetuals with 20x leverage, like signing up to ride a roller coaster. The ticket fee for the roller coaster is the risk of liquidation, i.e. losing all your money, but it’s worth it, so you can feel the rush.

Investing is now entertainment. Robinhood doesn’t compete with Charles Schwab and Interactive Brokers, it competes with TikTok and Instagram. In a world of addictive short-form content, speculation products offer asymmetric financial upside and rapid feedback loops to keep you glued to your screen, more so than doomscrolling.

NBA Commissioner Adam Silver was early to identify that zoomers (gen z) wouldn’t watch basketball games. A basketball game is weak stimulation compared to a 15 second gas station fight video on TikTok. Unless… you could bet on those games. This is why the NBA (along with the NFL, NHL, and NCAA) entered into licensing agreements and provided real-time data feeds to sportsbooks like DraftKings and FanDuel to allow fans to bet on sports games. Not just on who won or lost, but how many points Curry would score, whether the last point of the game would be a dunk, whether the halftime show would run over its allotted time, whether Harden would arrive to training camp overweight. This kept the zoomers glued to their screen because they had money on the line; a five dollar bet on a 5-leg parlay could win you a thousand dollars.

Traders are Celebrities

As investing becomes entertainment, top traders become the new celebrity class. These are people who have been early to under-appreciated assets, shared their bets publicly, held through highs and lows, and made a lot of money. Today, people look up to the top traders and treat them like professional athletes.

The most prominent traders in crypto today are Ansem and Cobie. Ansem shot into Crypto Twitter fame by buying Solana around its $10 lows and publicly broadcasting his bet. He became the de-facto leader for the large retail community that Solana onboarded through memecoins in 2024. His peak celebrity trader status came as actual celebrities like Iggy Azalea and Kanye West learned about crypto and launched memecoins. High profile people came directly to Ansem for advisory and support. Traditionally, celebrities built cultural capital through their work and cashed that in for money later. The trading class inverts this by becoming rich in public, winning cultural status as a result.

Cobie bought his first Bitcoin in 2012 and has publicly shared his trades and takes through Twitter and his podcast UpOnly. He’s unfiltered, funny, vulnerable, and makes you feel like you’re going through the ups and downs of crypto cycles along with him. In 2023, he built Echo, a platform to help people get access to early-stage investments in crypto projects — deals that were typically restricted to the likes of Cobie. Echo was growing fast, and Coinbase recently decided to acquire it for $375 million. You’d have to think that part of the premium Coinbase paid was for crypto’s number one celebrity trader: Cobie.

Crypto is creating celebrity traders with increasing frequency. Few months ago, pseudonymous crypto trader CookerFlips had an insane trading run, aping in early into winners like Aster, publicly sharing them on Twitter, and making $10 million over a few weeks. He then doxxed himself at the Token2049 conference and people started approaching him like he was a celebrity.

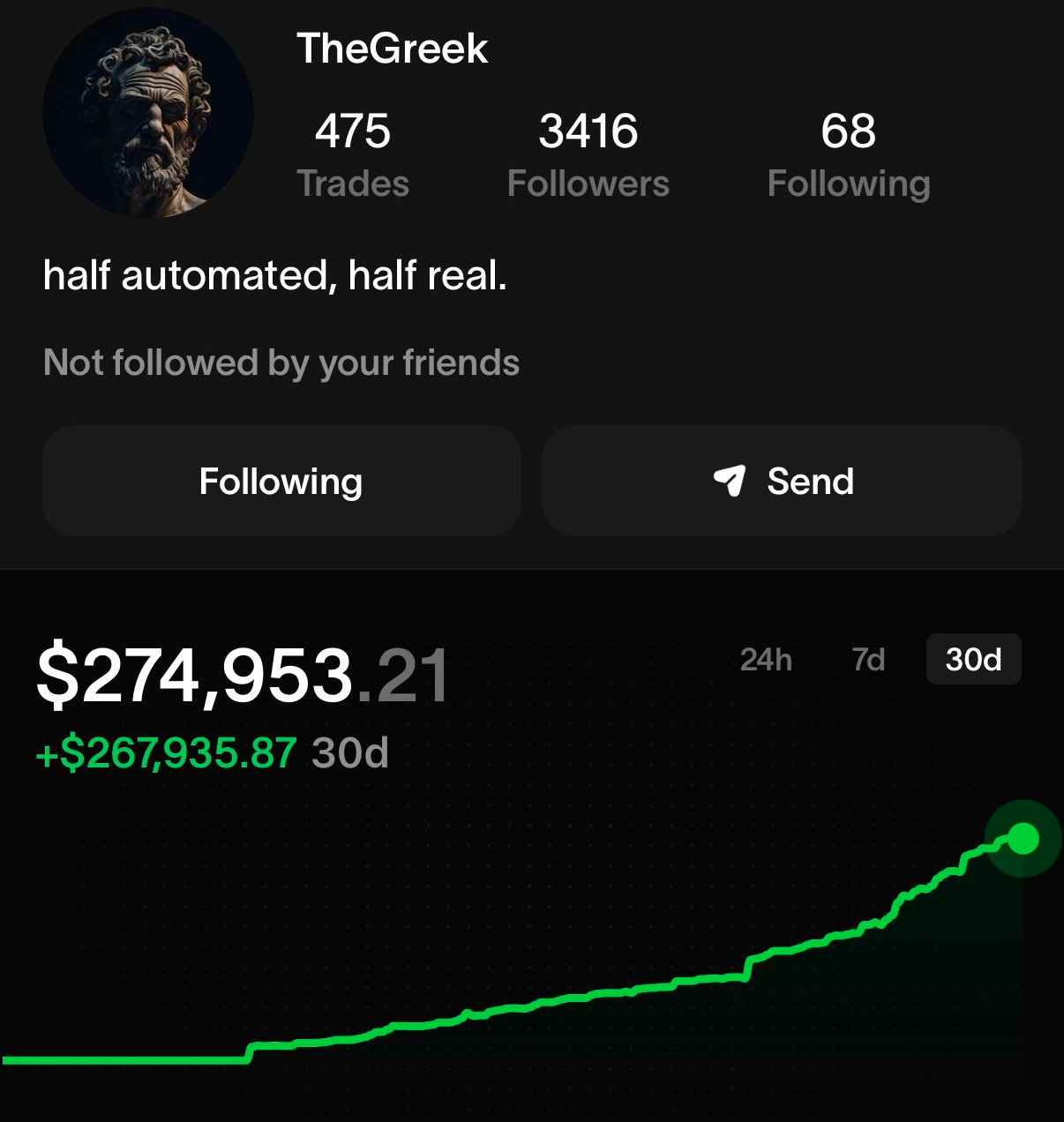

Products are now being built to surface the best traders to the public early. Anonymous trader ThePrimeGreek started with $6,000 on the social trading app Fomo and made $268,000 in 30 days. He gained 3,000 followers on Fomo and many requested him to create a Twitter account to share his takes.

The old model on social media was: build a following first, monetize later. The new model is: make money first, and the audience will find you. Positive P&L mints clout.

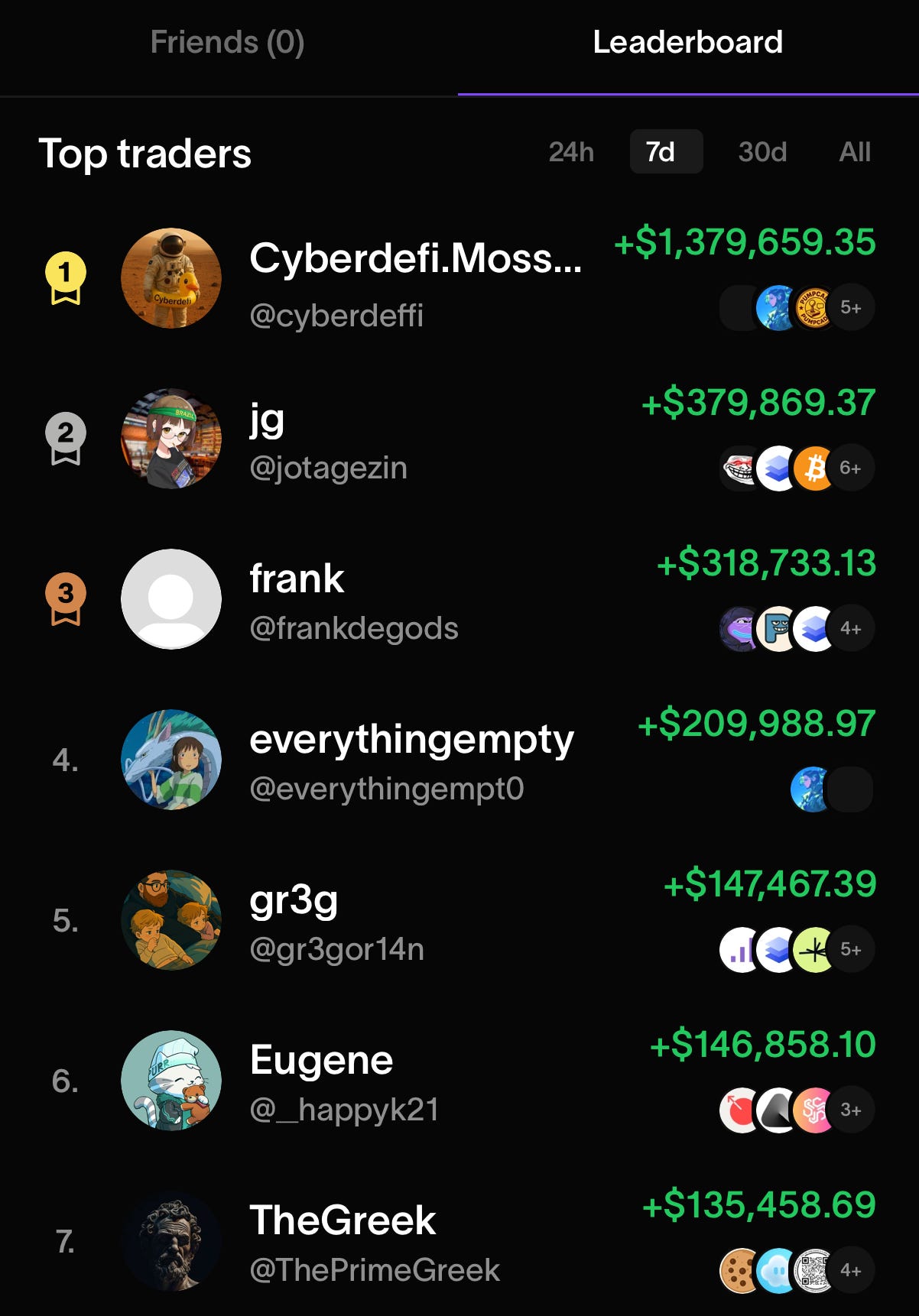

Apps like Hyperliquid, Bullpen, Clicker, and Farcaster have leaderboards of top traders and news feeds of their trades so you can copy them. Robinhood introduced its social feature to follow your favorite traders, show off your recent gains, and copy trades. The crypto version of one-click checkout is one-click copy-trade.

The first mainstream investing community was the subreddit WallStreetBets, which launched in 2012. In September 2019, the user DeepFuckingValue famously opened a $53,000 long position on GameStop and posted about it on r/WallStreetBets. GameStop was doomed for bankruptcy with big short positions from prominent hedge funds like Melvin Capital Management, Citron, and D1 Capital. However, DeepFuckingValue led a populist revolt of retail traders against the big hedge funds that drew significant retail demand, especially options volume on Robinhood. The stock went up 28x in four weeks in January 2021, leading to a massive short squeeze. Melvin Capital Management lost 50% of their capital and had to shut down. DeepFuckingValue was the first populist trader celebrity. He was interviewed by the Congress, profiled by Wall Street Journal, and has multiple books written about him. It was a sign of things to come.

On WallStreetBets, there was no way to verify if the statements people made were accurate. The latest trading apps like Fomo make the trades and P&L verifiable. Now, people share their ups and downs with each other in real-time. It’s like going to a concert together, except you’re head banging to wild swings in your P&L.

In-person events are being organized in New York, Seoul, and Buenos Aires to bring together these celebrity traders in one location to participate in real-time trading competitions. There are multiple rounds to audition the best traders, and the final contest involves 5-10 teams going head-to-head to generate the highest P&L for a prize. The event is livestreamed with a prediction market for people to bet on who is most likely to win.

Someone even started a memecoin trading club in his high school.

When teenagers were asked who they want to become when they grow up, the answer used to be a professional like a doctor or lawyer. About five years back, the answer was a YouTuber. Soon, it will be a trader. The American Dream is to get rich *quick*.

Great article 👏🏽

That video of celebrity traders, with people cheering the names of the traders, is unreal.