The Business of Sportsbooks is Built on Losers

A deep dive into the economics of sportsbooks, why they ban the best bettors, and how the law protects this.

To successfully run a traditional sportsbook like FanDuel or DraftKings, you need to identify your highest performing bettors early, and ban them.

A sportsbook is a licensed operator that sets the odds for each sporting event and takes the other side of the bet. Contrary to what many think, a sportsbook is a low margin business. They owe up to 51% in state taxes1, pay over $3002 to acquire every new user, and have a smaller house advantage than casino games like craps or slot machines. They cannot afford highly skilled bettors, known as sharps. The average casual bettor loses $100 a year3; one sharp bettor winning $100,000 wipes out the losses of 1,000 casual bettors. Sportsbooks survive by attracting unsophisticated sports fans who are likely to bet on their own favorite sports team; only around 3% of them are profitable.

In the US, a business can refuse service to practically any customer, as long as they do not discriminate based on race, religion, sex, etc. Sportsbooks take advantage of this common law principle to identify their most unprofitable customers early and limit how much they can bet.

DraftKings CEO said at an investor summit in 2021:

This [sports betting] is an entertainment activity. People who are doing this for profit are not the players we want.

The business of sportsbooks is built on losers.

Exchanges vs. Sportsbooks

There are two main ways to facilitate sports betting: exchanges and sportsbooks.

An exchange is a marketplace where people bet against each other instead of against the house. Users post offers and odds are determined by demand and supply, like in a financial market. The exchange itself doesn’t take risk; it only matches bets and charges a commission, typically 2-5% on winnings. Betfair pioneered the sports exchange model, which remains uniquely popular in the UK. In most other countries, however, sportsbooks are the dominant model for sports betting.

A sportsbook is a licensed operator that sets the odds and takes the other side of the bet. If the user wins, the sportsbook pays them. If the user loses, the sportsbook keeps their stake. The two biggest sportsbooks are DraftKings and FanDuel, which have over a 75% market share in the US.

How do Sportsbooks Make Money?

Sportsbooks make revenue from the vig, a small margin built into the odds for a particular bet that ensures the house profits over time. For simple, straight bets like “Lakers will beat the Warriors”, the vig is lower at around 5%, meaning the sportsbook expects to keep $5 out of every $100 wagered on those bets before paying operating costs, promotions, and taxes. Unlike straight bets, parlays are a complex bet that combines multiple independent bets. For parlays, like betting on both “Lakers will beat the Warriors” and “Lebron will score below 15 points”, the vig can go up to 20%.

When you aggregate the vig per bet across all the different bets in a sportsbook, you get its structural hold on handle. Handle is the total amount bet on the platform and structural hold is the percentage of the total handle the sportsbook expects to keep after paying out winners but before paying for operating expenses, promotions, and taxes. Structural hold is the blended percentage across low-vig straight bets (simple bets with low margin) and high-vig parlays (complex bets with high margin).4 A sportsbook’s structural hold on handle is its primary driver of profitability.

Product Design and Psychology That Pushes Users to Parlays

Parlays are a profit engine, so the more a sportsbook can lure novice players into high risk parlays which combine multiple bets, the higher their structural hold is.

Facebook, in its early days, had a magic number: if a new user added 7 friends within 10 days, they’re highly likely to become a long-term active user. If I had to arrive at a similar magic number for sports betting apps, it would look something like this:

A new user who makes a first deposit and places 3+ real-money bets within the first 7 days, with at least one parlay bet, is very likely to become a retained, revenue-positive customer.

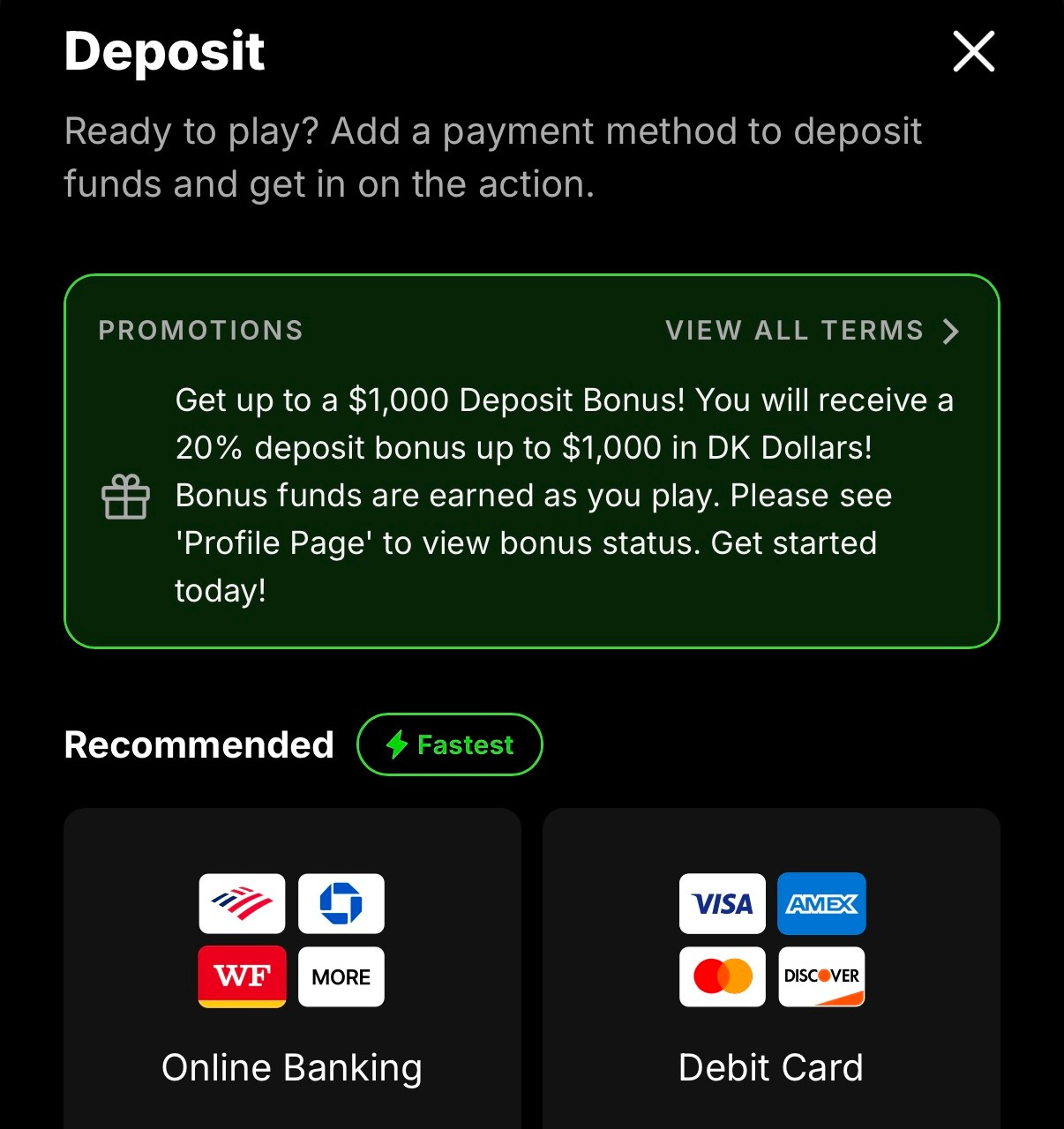

When you sign up on DraftKings, the first action they want you to take is to deposit money, for which they offer a 20% bonus reward:

The second action they want you to take is to place a bet, specifically a parlay. In the screenshot below, DraftKings displays Lebron James’s handpicked parlay so you can place this bet with a few clicks: “James Cook to score a touch down + Jonathan Taylor to score a touch down + Garrett Wilson to score a touch down”.

DraftKings introduces an authority figure in Lebron who backs this bet, they add social proof (“11.1K people placed this bet”), and they make the financial upside compelling ($10 pays $59). Instead of combing through stats, setting up custom parlays, or doing your own math, the app puts a trusted face to recommend a bet that is most favorable to the house.

DraftKings and FanDuel love parlays because they drive an increase in their structural holds on handle, i.e. the house’s take rate. Sports fans love parlays especially within the same game because they can weave a story around the bet. The bet also keeps you glued to your screen, so it makes the game more entertaining.

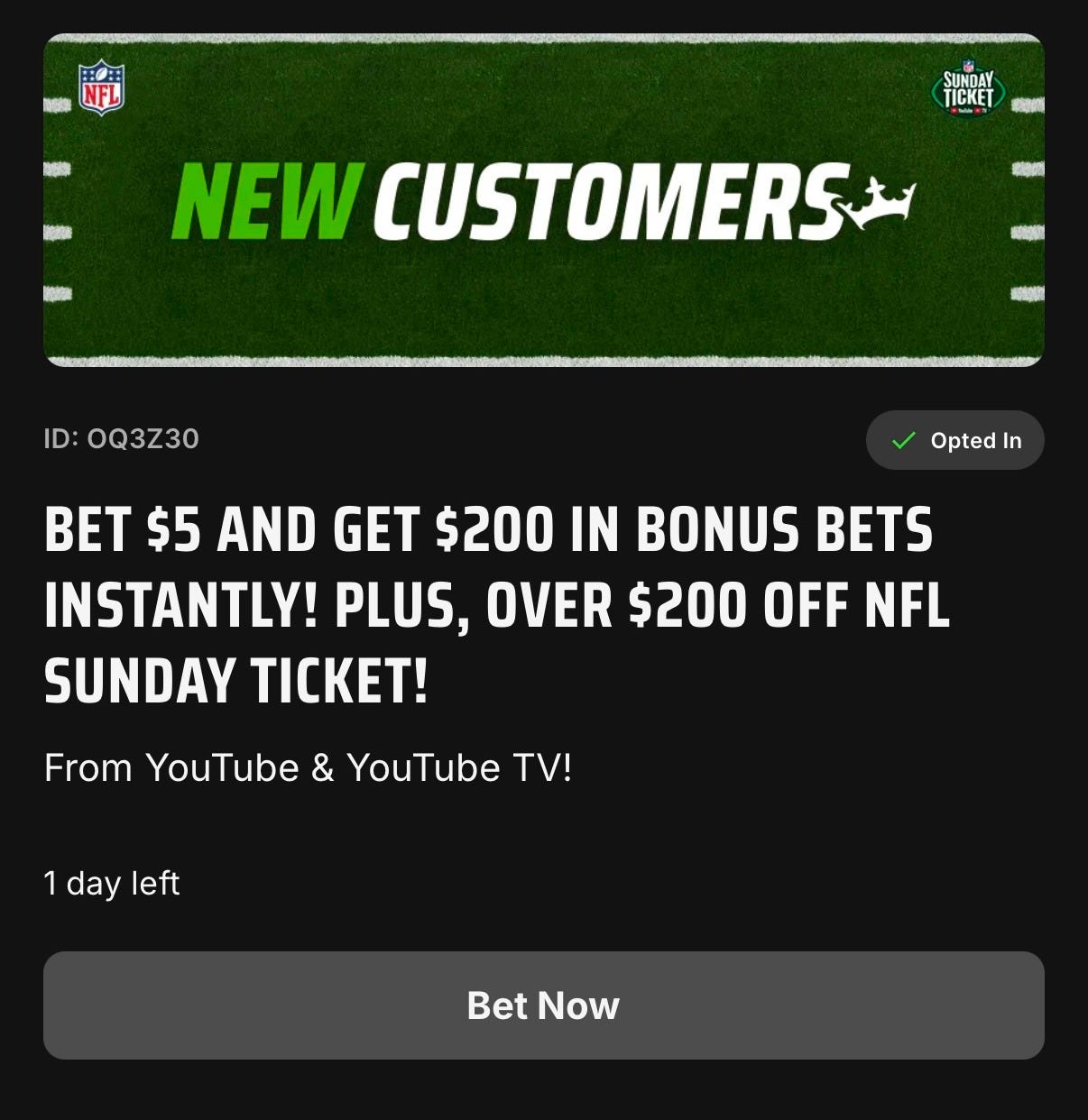

To make sure you go through with your first bet, they offer you a $200 bonus that expires within 24 hours:

Even if you didn’t like Lebron’s recommendation, DraftKing displays an entire carousel of parlays so you can’t escape them:

Once you’ve placed a bet, they send you a push notification the next day offering you a bonus to bet so this becomes a daily habit:

Costs: Promotions, Advertising, and Taxes

Despite all these optimizations, sportsbooks operate on thin margins. DraftKings’s structural hold on handle is currently 11% and FanDuel’s is 14%, leaving little room to pay for its costs, which are significant.

Sportsbooks have three main costs: promotions, advertising, and state taxes.

Promotions include free bets, bonus bets, deposit matches, and odds boosts. DraftKings has a signup offer of $200 in bonus bets along with a 20% deposit match up to a cap. While they do not disclose how much in total they spend on promotions5, it is likely they spent over a billion dollars in 2024 since they added 3.5 million new customers.

Advertising is the primary way for sportsbooks to acquire new users. Sports betting is still new in many markets and sportsbooks have winner-take-most dynamics, so DraftKings spends about $300 to acquire each new user, adding up to a total spend of $1 billion in 2024. Advertising spend includes Kevin Hart’s Super Bowl commercials, official sponsorship of the NFL, paid search and paid social marketing, among others.

States consider sports betting as a “sin” good, so they tax betting revenues heavily to boost the state budget and minimize political pushback. New York, New Hampshire, and Rhode Island take 51% of online sportsbook revenue. Pennsylvania charges 36%, Illinois charges 40%, while most other states fall in the 10-20% range. Because this tax is charged before sportsbook expenses like payment processing, real-time data feeds, marketing, and product expenses, it cuts deeply into their margins.

DraftKings has operated at a loss for the past three years because they’ve spent heavily on growth and state taxes have eaten away at margins.6

Why Sportsbooks Restrict Sharp Bettors

In 2022, Washington Post reported a bettor Beau Wagner who bet $1,000 and won $50,000 on an NBA game. He tweeted a screenshot of his winning bet, and DraftKings reposted it with the caption, “BEAU KNOWS BETTING”. However, a day after his successful bet, his betting limit was severely restricted to a grand total of three dollars and sixty three cents. DraftKings used his win as an advertisement to lure new, unsophisticated bettors to the platform, but they shut down the very bettor they were advertising.

Around 1% of bettors on the platform are limited, according to BetMGM. Sharps are a small share of accounts but not necessarily a small share of handle. That tiny cohort can bet large, target weak markets, and materially drag blended margin for a sportsbook.

The structural hold on handle, the take rate of sportsbooks, is 11-14%. After paying for promotions, federal excise taxes, state gambling taxes, and advertising, the margins fall to low single digits. Sportsbooks cannot afford sharps.

The overwhelming majority of bettors place bets with negative expected value. Sharps are bettors with positive expected value. Sharps do not make the obvious parlay bets that sportsbooks have pre-packaged for users to make. They may exploit arbitrage opportunities across multiple sportsbooks, bet before the odds refresh after big plays, or find the best price and take advantage of the slowest book. They aren’t sports fans who like to casually bet; they are professional gamblers.

Right to Refuse Service to Any Customer

The industry defends the act of restricting sharps. The Director of Colorado’s Division of Gaming has said that there is no right to be a professional sports gambler and that it is simply “a form of entertainment”.

In the US, a business has a right to refuse a customer for pretty much any reason, as long as they do not discriminate against protected classes like race, gender, sex, national origin, among others. Sportsbooks have advanced data science teams to identify potentially unprofitable customers (sharps) and heavily restrict their betting limits early.

Businesses denying service to customers is nothing new. There are comical examples outside of betting where businesses turn away customers they don’t want. As Hacker News user cortesoft puts it:

You could refuse to do business with someone because you didn’t like the way they looked at you, or because you were grumpy the day they came in. Famously, for example, James Dolan [CEO of Madison Square Garden Entertainment] bans all sorts of people he doesn’t like from Madison Square Garden and any of the other venues he owns. He notoriously bans all lawyers who work for any firm that sues him (which happens a lot). He even uses facial recognition to catch them, and kicks them out without refunding their tickets. People have tried to sue him for this (many of them are lawyers, after all!) and so far no one has won against him for it, so he keeps doing it.

Conclusion

Sportsbooks make their money by tempting casual sports fans into making complex parlays, which rarely ever win but drive revenue for sportsbooks. Despite this, sportsbooks operate on small margins, so they cannot afford sharps, whose bets have positive expected value. They consistently restrict their best bettors, and optimize their product and marketing to attract losers.

New York, New Hampshire, and Rhode Island impose a 51% tax on sportsbook revenue. For most other states, taxes are between 10% and 20%.

In DraftKings’s 10K in 2024, Customer Acquisition Cost (CAC) is defined as external marketing spend divided by new customers. In 2024, DraftKings’s advertising costs (proxy for external marketing spend) was $1.1 billion and it acquired 3.5 million new customers, giving it a CAC of ~$300 per customer. However, this is a blended CAC across all of DraftKings’ business lines: sportsbooks (61%), iGaming or casino (32%), and others like Daily Fantasy Sports (7%). Sportsbook-only CAC is likely higher than the blended CAC figure since sportsbooks require heavy promotions to acquire users, while online casino and daily fantasy sports often come through cheaper cross-selling.

For example, if 70% of handle is straight bets at a 5% vig and 30% of the handle is parlays at a 20% vig, the structural hold on handle is 70% x 5% + 30% x 20%, which is 9.5%.

In DraftKings’s financial statements, promotions are netted against revenue. This means they aren’t considered a separate cost item on the financial statements, but are subtracted from gross revenue to get net revenue.

FanDuel is acquired by Flutter and doesn’t report standalone financial statements.

I didn’t know about the difference between sportsbooks and exchanges, reminds me of 1P vs 3P in e-commerce

With that analogy, I’d predict that (regulations permitting) exchanges eventually win out vs sportsbooks. Exchanges have a lot of advantages:

- Capital efficiency: a sportsbook needs to reserve capital to pay out bets, so it needs to invest more capital to grow. An exchange uses 3rd-party capital, so it doesn’t have this constraint

- Breadth: a sportsbook is constrained by its capacity to create and underwrite bets, an exchange can use its broad network of bettors to create more (and more creative) bets. I’d argue you’re already seeing this, with prediction markets offering bets on the color of sex toys thrown onto a basketball court

- Pricing: an exchange is willing to accept a lower vig than a sportsbook, because it’s taking no risk (it makes money no matter the outcome). This translates to better odds for bettors

- TAM: the core flaw of sportsbooks noted in this post (that they ban sharps) doesn’t exist in exchanges. Because the exchange makes money in every outcome, it has no incentive to ban sharps. This creates a bigger, more liquid marketplace

This mirrors the 1P -> 3P shift in e-commerce, all big e-commerce marketplaces today (Amazon, DoorDash, Uber, Airbnb, etc) are majority if not all 3P.

My sense is exchanges don’t exist in the US because of state regulations, but prediction markets (which are exchanges) seem to have found a loophole. I’d argue prediction markets pose a significant threat to the online sportsbooks unless Draftkings / Fanduel start shifting to an exchange model themselves

Were you a sports better before starting this serious? Have you done any experimental market research?