Dopamine Markets: 2025 Annual Letter

Investing is entertainment, traders are celebrities, BREAKING news comes with live odds, everyone has inside information, the American dream is to get rich quick.

At New Year’s, my friend pulled me aside to chat separately. He recently broke up with his girlfriend and we hadn’t spoken since, so I was ready to talk about it. He said, “I’ve been meaning to ask you for a while. What crypto coin can go up 10x?”

He hadn’t bought stocks before, doesn’t watch CNBC, doesn’t track markets, and has a low risk appetite. He is, I thought, a “my savings are in some retirement ETF I don’t know about” kind of guy. But he’s representative of a growing number of (mostly) men1 who take swashbuckling swings in financial markets, partly to escape the permanent underclass, partly for the thrill of it, but largely because *now they can*. The smartphone has put a casino in every pocket, and people can’t help but spin the wheel.

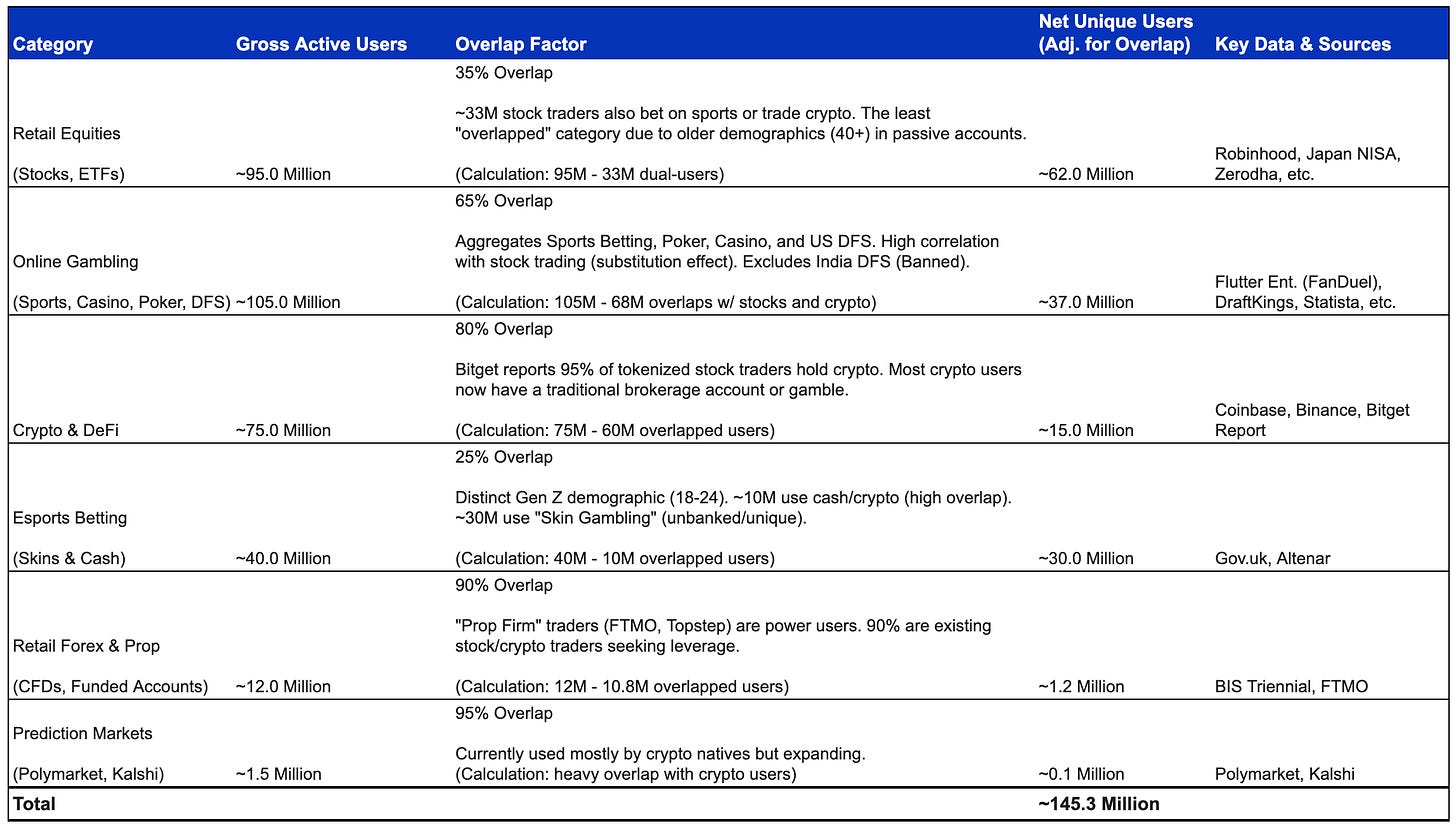

Over the last decade, retail participation in financial markets has grown from a trivial amount to over a hundred million monthly active traders2. Unlike the speculative mania of the 1920s or the dot com bubble of the 1990s, this increase in retail participation represents a structural change that is likely to persist across market cycles.

We are on the path to a billion active traders.

2025 will be seen in retrospect as an important year in the history of financial markets.

The SEC led by Gary Gensler, defined by its regulation-by-enforcement style, was replaced with a technology-forward, permissive one. The former COO of PayPal was appointed as the AI and Crypto Czar. The SEC rescinded SAB 121, now allowing banks to custody crypto without having to list those assets as liabilities on their balance sheets. They dropped cases against OpenSea, Robinhood, Coinbase, and Uniswap. They stated that memecoins weren’t securities. They did everything the crypto industry dreamed of, and more.

The result? Crypto prices fell 26% by April and never really recovered.

But retail participation in financial markets grew significantly over the year across multiple categories.

Equities3

Options4

Sports Betting5

Perpetual Futures6

Prediction Markets (the newest addition)7

On election night, November 5, 2024, I, like many others, learned who won the Presidency not from CNN or Fox News but from Polymarket. I had CNN’s election broadcast on my TV and Polymarket odds pulled up on my phone, refreshing it every other minute. By night, Polymarket odds jumped to 95% for Trump, while CNN called the election the next day8. It was clear that this was a landmark moment for prediction markets.

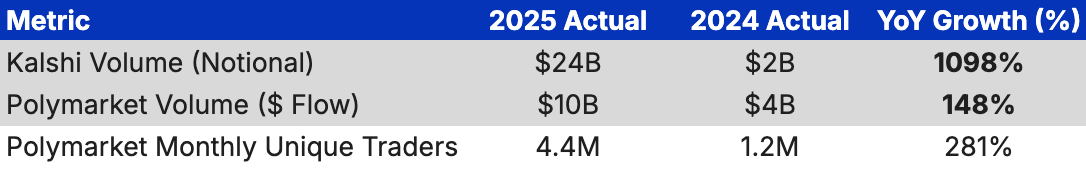

The 2024 election market attracted over $4 billion in volume between Polymarket and Kalshi, and they leveraged this success to go big in 2025. Polymarket got a CFTC license through the acquisition of the derivatives exchange QCEX, which let them finally launch in the US. Kalshi and Polymarket are being integrated with major exchanges (Coinbase, Robinhood), wallets (Phantom, MetaMask), and media platforms (CNN, CNBC). “What’s the Polymarket at?” became a common phrase used by mainstream celebrities like Joe Rogan and Elon Musk.

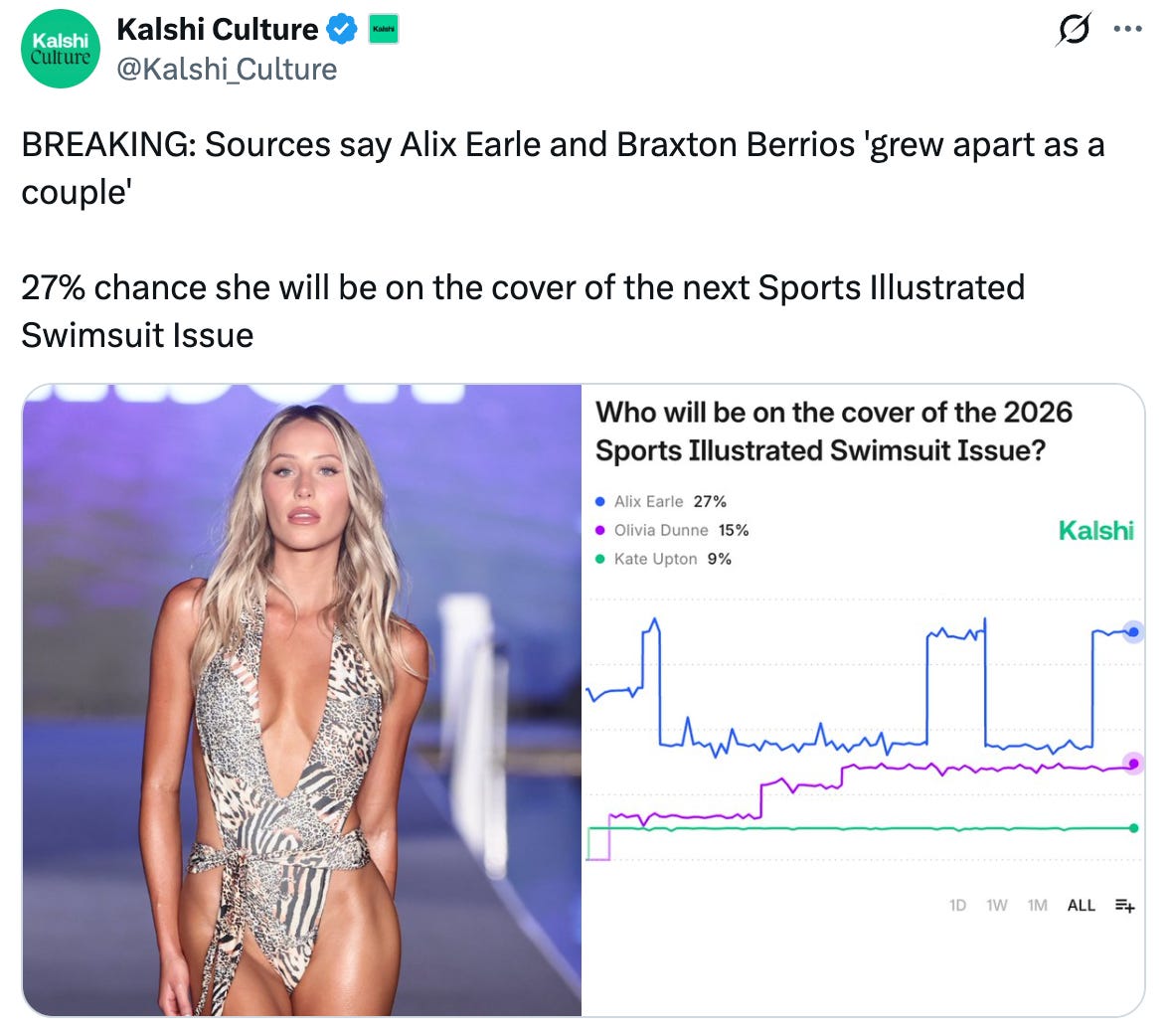

Nothing was too trivial to bet on. Polymarket and Kalshi used the all-caps “BREAKING:…” news format to post about the most inane things like celebrity gossip:

And TV show finales:

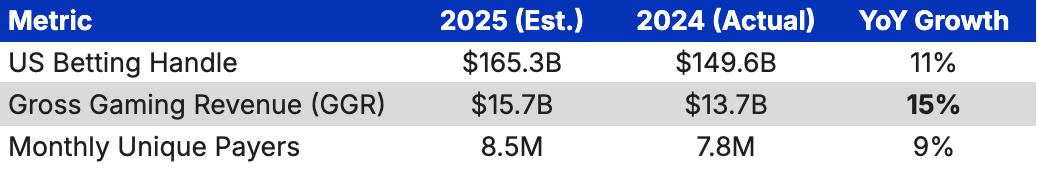

Breaking news now comes with live odds, and nearly anything can become a market: elections, foreign policy, celebrity gossip, and most importantly, sports. Sports betting attracts a lot of dumb money that platforms can profit from: sports fans like to bet on their favorite teams, load up on lottery-style parlays, and 95% of them lose money. An estimated $165 billion was wagered on sports in 2025; by (likely) underwriting explosive growth in sports betting, Polymarket was able to raise $2 billion at a whopping $9 billion valuation from Intercontinental Exchange, the owner of the New York Stock Exchange. Kalshi raised $1 billion led by Paradigm at a reported $11 billion valuation. As expected, Polymarket and Kalshi launched sports prediction markets across all US states to compete with the incumbent giants FanDuel and DraftKings. The incumbents saw their stocks fall 30% as a result. But since prediction market event contracts for sports resemble sports gambling, which is regulated on a state-by-state basis, Kalshi faced multiple enforcement actions by states like Massachusetts and New York.

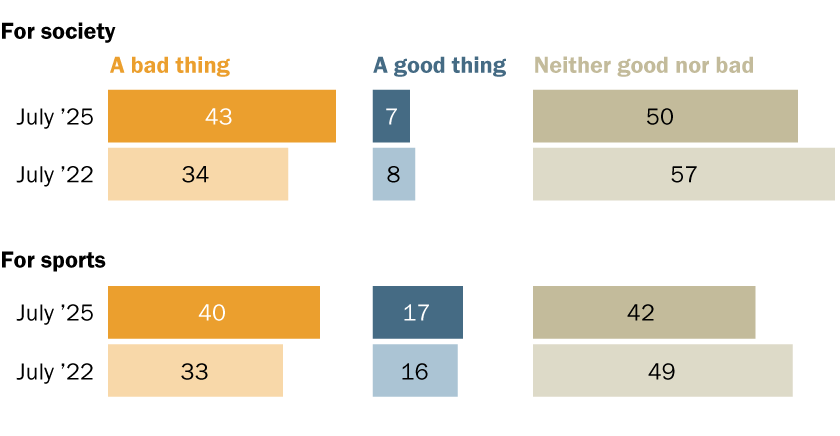

For the first time since its legalization in 2018, sports betting started to experience public perception problems. According to a Pew study in July, 43% of Americans said that sports betting was a bad thing for society, up 9% from three years earlier.

In October 2025, the FBI publicly disclosed “the insider trading saga for the NBA”. They arrested Terry Rozier (Miami Heat guard), Chauncey Billups (Portland Trail Blazers head coach), and several others in an illegal betting investigation. Terry Rozier allegedly took himself out of a game on purpose so a co-conspirator could win a sports bet. Jontay Porter bet on his own games and manipulated his performance so a co-conspirator could win money on prop bets. Chauncey Billups was involved in a long-drawn scheme to defraud players in poker games.

When everything becomes a market, everyone has inside information.

Now, athletes and their associates, musicians and their friends, founders and employees of AI companies, and politicians and their staff, all have privileged access to information they can trade on every day. And evidence shows that they are: Taylor Swift’s engagement proposal, Google’s search ranking, the 2025 Nobel Peace Prize winner, and over 100 UFC fights all have allegations of insider trading. While these aren’t proven yet, there are signs that the democratization of investing leads to the democratization of white collar crime.

Prediction markets were culturally loud but still financially small compared to the biggest trade of the year: AI stocks. Jensen Huang said that AI is a five-layered cake: energy, chips, infrastructure, models, and applications. Well, each layer of the cake went parabolic in 2025. AI stocks accounted for 80% of the stock market gains till October 2025. There is tremendous interest in making stocks of private AI companies tradable: Robinhood tokenized OpenAI’s stock and made them available for select European users, but OpenAI publicly rejected the legitimacy of these stock tokens.

For all the talk of an AI bubble, it still doesn’t feel irrationally exuberant like the dot-com boom. The AI companies being bid on in public markets are some of the most profitable businesses in human history. Investors are paying close attention to the earnings of these companies, given the enormous amount of capital expenditure on data centers and hiring engineering talent.

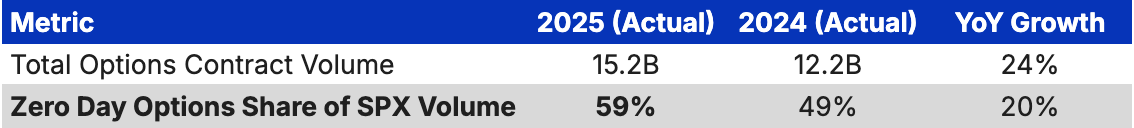

Retail doesn’t express their appetite for gambling by buying stocks; they do by buying zero-day options, which grew to a staggering 59% of total options volume in 2025. Perpetual futures take that impulse further, offering users 20-100x leverage on tap with no expiration date. Perps were originally designed by Nobel Prize-winning economist Robert Shiller to help ordinary households hedge against long-term economic risks like housing prices or GDP growth. Little did he know how degenerately they would be used a few decades later.

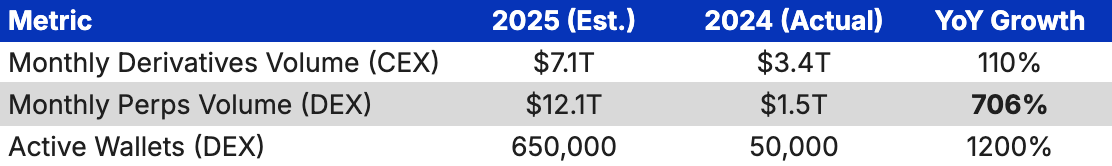

Over 2025, perp trading volume on centralized exchanges grew 110%, dominated by Binance, Bybit, and OKX. On decentralized exchanges, perp trading volume exploded, up 1,244%. Most of that growth came from Hyperliquid, the breakout crypto app of the past two years, with growing contributions from aggressive new entrants Aster and Lighter.

Coinbase laid out a vision for the “perpification of everything” from public stocks like Tesla to private companies like OpenAI to macro-economic indicators like VIX. Robinhood launched perps for its European customers and wants to do so in the US as well, pending regulatory approval.

Millions of mainstream users will soon have access to industrial-grade leverage, once reserved for Wall Street trading desks, not twenty-somethings trading from their toilet.

It is becoming clearer that investing is entertainment.

Robinhood doesn’t just compete with Charles Schwab and Interactive Brokers, it competes with TikTok and Instagram.

Investing used to be logging into your Fidelity 401K account every other month, but that puts people to sleep. Investing is now trading perpetuals with 20x leverage or buying memecoins that may go bust the next day, refreshing your trading app every few minutes to see if your net worth chart is going up or down.

As investing becomes entertainment, top traders become the new celebrity class. These people have made under-appreciated bets early, publicly announced them, relentlessly shilled their bets, and turned out to be correct. They have rags-to-riches style stories of wealth creation in a short amount of time.

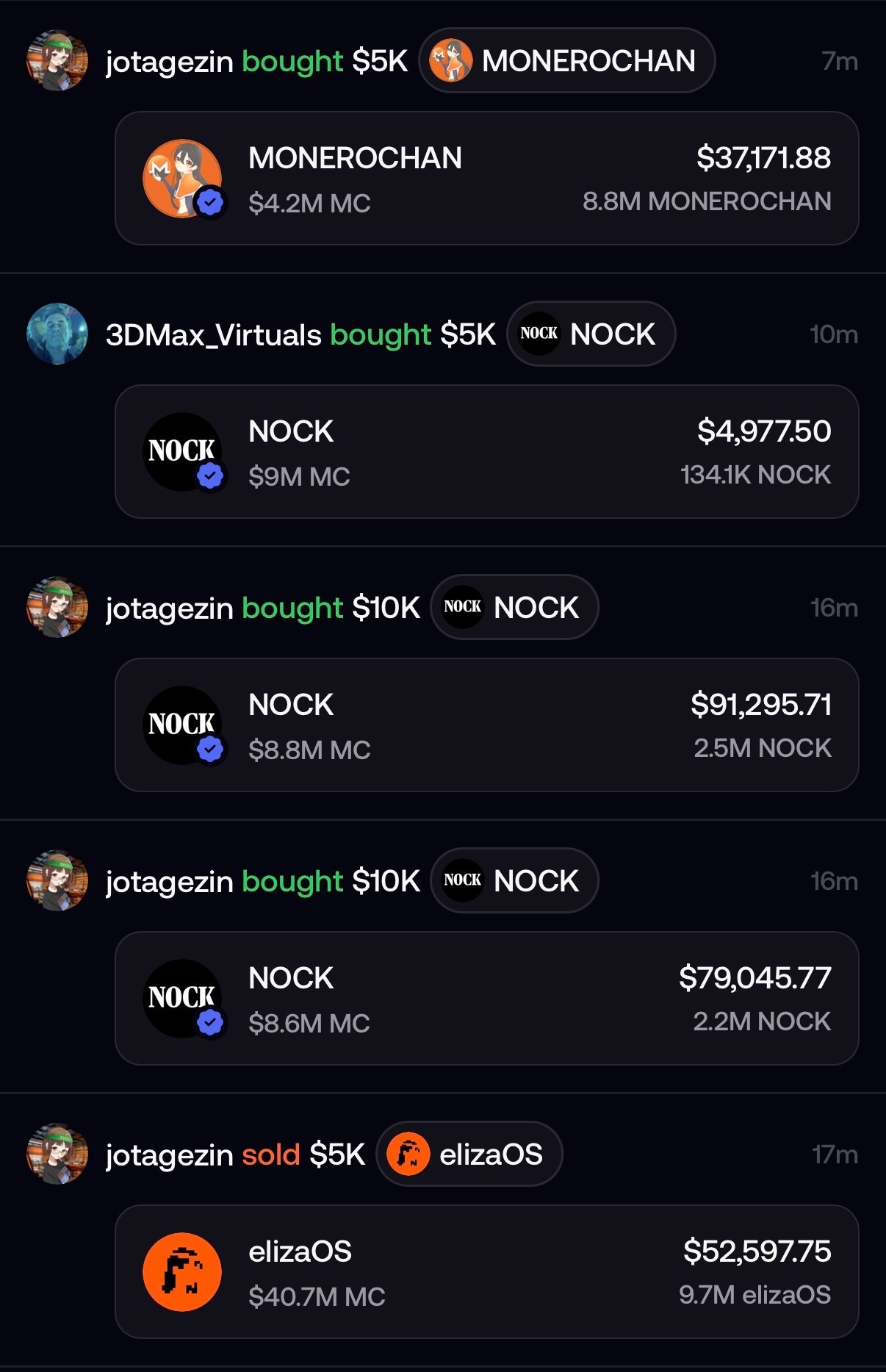

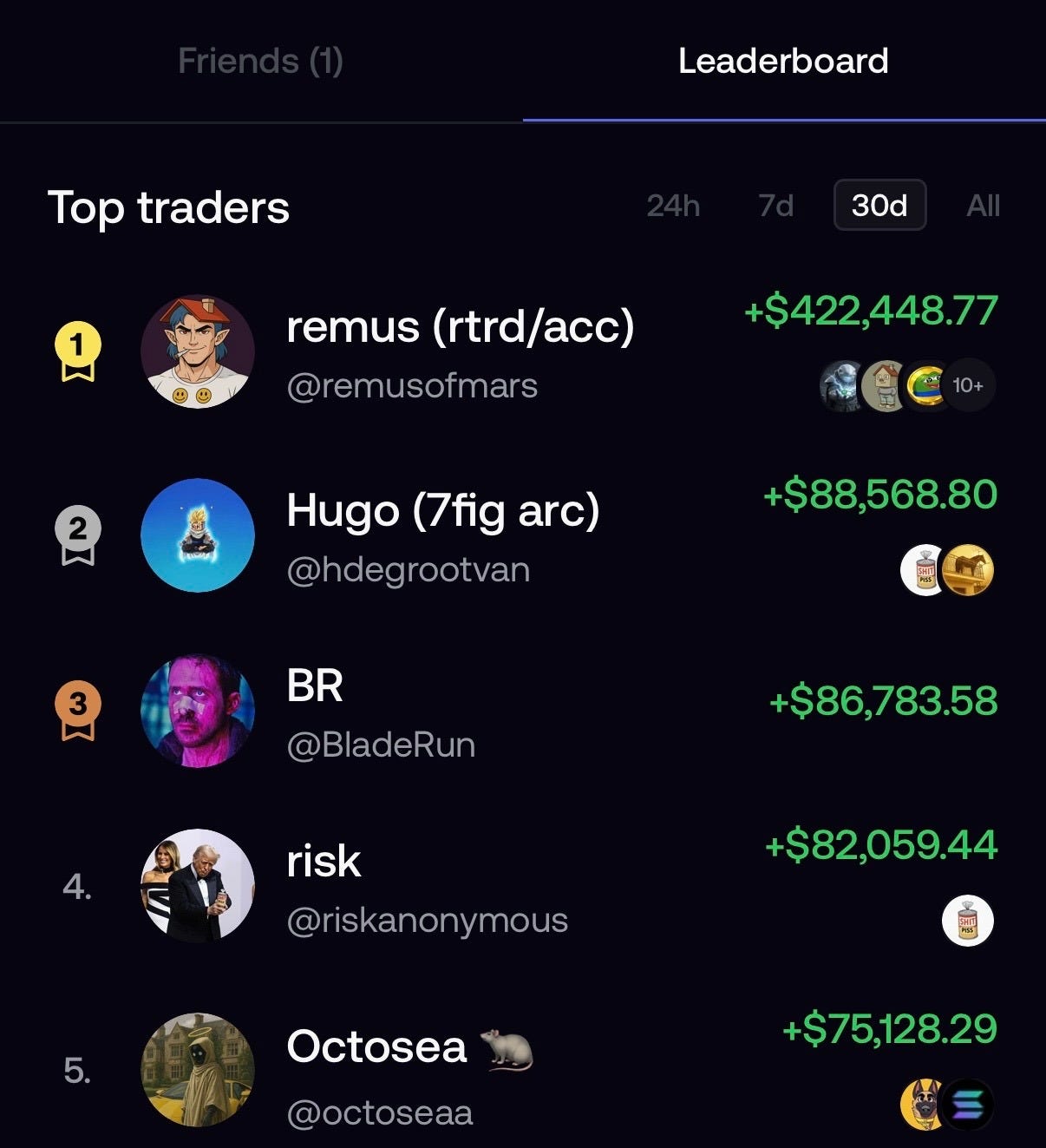

A recent example is Remus, a pseudonymous account that started with $370 and made $500,000 by buying the memecoin WhiteWhale. He trades on Fomo, a social trading app that shows you a feed of traders, their buys and sells, and the ability to copy their trades with one click.

The Fomo leaderboard shows the exact amount of money traders have made over the past day, week, and month, in an effort to induce fomo to trade, as the name suggests. Top traders become instantly well-known; Remus has made the most money over the past month, so he is the latest celebrity trader. The old model on social media was: build a following first, monetize later. The new model is: make money first, and the audience will find you. Positive P&L mints clout.

Remus is celebrated on Crypto Twitter for “reviving the memecoin trenches”, a reference to trench warfare, where men were knee-deep in mud, surrounded by rats and exploding shells, only to die in a few months. Today, it’s used to describe being in a terminally online group buying an animal-themed memecoin. Remus is lionized by Crypto Twitter for helping people “regain hope”, being the future of “social finance”, a true “GOAT”, having “the most shared PNL card in the history of crypto”, and getting “big props” from celebrity traders like Ansem. With the amount of praise he’s getting, you would think he is a war hero returning from Normandy.

What is Remus’s motivation? Make as much money as possible today because the opportunity may not exist tomorrow.

The operating maxim of today is to secure the bag. The cardinal sin used to be selling out; God forbid your favorite band did a McDonald’s commercial. But today we encourage people to sell out while they still can because real wage growth has stagnated, housing is exorbitant, student debt lingers on for decades, and the perceived window to cash out is small.

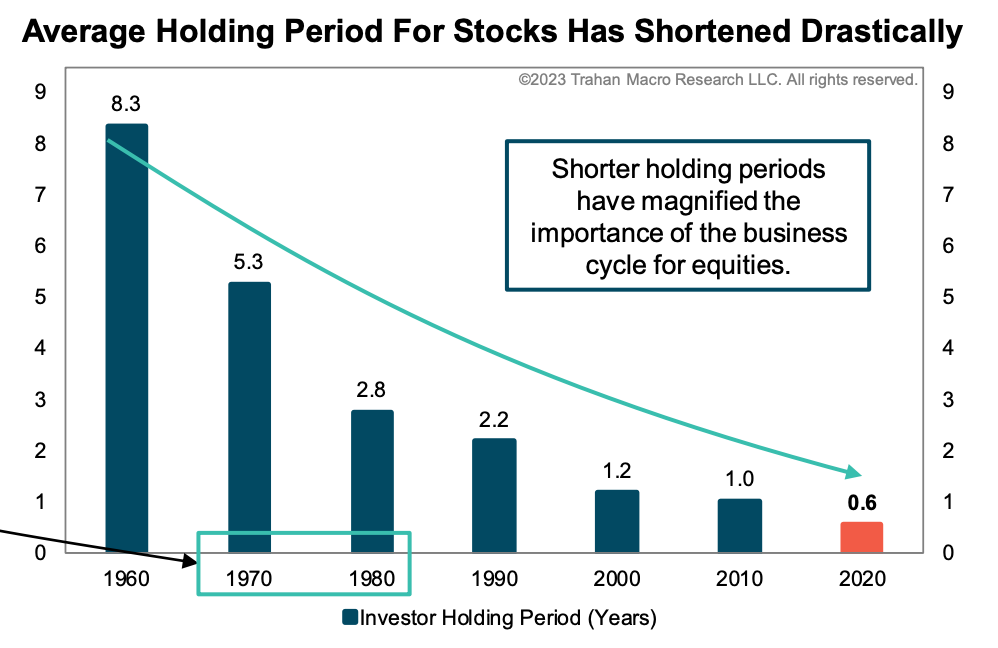

Holding periods for assets have drastically shrunk from over eight years in 1960 to months in 2020. Retail participation in financial markets has increased and investors have gotten myopic. It is fitting that Warren Buffet retired in 2025, as the “buy and hold” era retired with him. Zero-day options, perpetual futures, prediction markets, and memecoins have only compressed holding periods further.

I have spoken to traders who will manually buy and sell multiple memecoins in thirty-minute intervals, riding up a Pump.fun price chart and selling before they anticipate a drop. When I asked one trader what he thought about the time horizon of his strategy, he paused to reflect, then admitted that he, in fact, was “too long-term oriented” and needed to compress his trade cycles to ten-minute intervals.

Trading is becoming an esport, moving from a single-player activity to a spectator event that can be watched on stage and over a livestream. It seems weird, but watching nerds play video games on Twitch also felt weird in 2011. In September, a live perps trading competition was held in Seoul that went viral. These events usually follow a tournament format: multiple rounds to audition the best traders, followed by a final showdown in which the top five traders go head-to-head with the goal of generating the highest P&L over an hour for a large cash prize and indefinite bragging rights. The competition draws celebrity traders who livestream the event, with a parallel prediction market letting viewers bet on the winner.

The “traders as celebrities” phenomenon is spilling over to the normie world; someone even started a memecoin trading club in his high school.

When teenagers were asked who they want to become when they grow up, the answer used to be a professional like a doctor or lawyer. Around five years back, the answer was a YouTuber. Soon, it will be a trader (the guy who pulls you aside at New Year’s to ask you what coin will 10x). The American Dream is to get rich *quick*, and smartphones now export this fantasy to billions around the world.

Footnotes

Women have achieved near-parity with men in stock market investing; 71% of women now invest in the stock market. Women also gamble heavily on casino slot machines and speculate on cultural collectibles like labubus. But so far, most aren’t drawn to speculation on the smartphone via options, sports parlays, memecoins, and perps. I do know several founders who are working to “solve this problem”, though. Women should gamble too! They deserve to access 50x leverage and be liquidated too!

It is difficult to accurately estimate the number of monthly active traders globally, but I attempted to do a rough estimate. The table below accounts for major categories of speculation and adjusts for overlapping users, e.g. there is a high overlap between online gambling users and those who trade stocks and crypto. The numerical precision shouldn’t be taken as seriously, but it is fair to say there are at least 100 million monthly active traders.

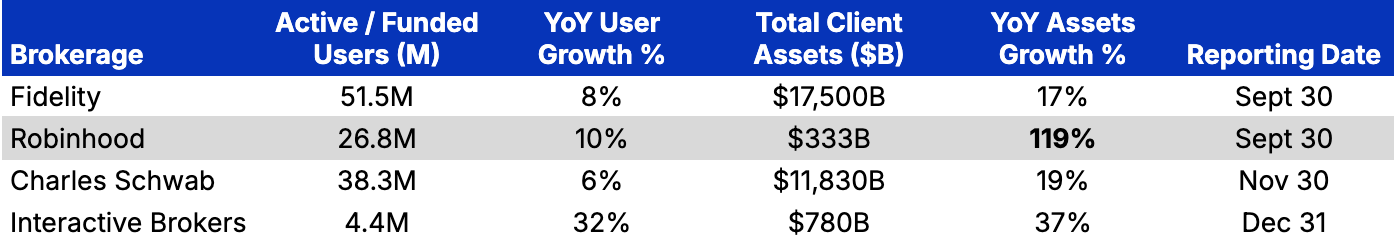

Notes on equity brokerage data:

Fidelity: Sept 30 report

Robinhood: Q3 report

Charles Schwab: Nov 2025 press release, Nov 2024 press release

Interactive Brokers: Dec 2025 report

Definitions for active users and client assets differ for each firm and are presented in their reports.

Notes on sports betting data:

US betting handle: 2024 actual (source). 2025: $113B between Jan-Sept (source), $17.8B in October (source). Jan-Oct handle was 79.3% of total 2024 handle. Assuming the same ratio and seasonality for 2025, estimated total handle is $165.3B.

Gross Gaming Revenue (GGR): 2024 actual (source). 2025: $11.1B between Jan-Sept (source), $1.6B in Oct (source). Jan-Oct GGR was 80.6% of total 2024 GGR. Assuming the same ratio and seasonality for 2025, estimated GGR is $15.7B.

Monthly Unique Payers (MUPs): refers to the number of users who have made at least one transaction in the month, sourced from financial statements of DraftKings and Flutter, which is the parent company of FanDuel. DraftKings and FanDuel have 70% market share [1]. DraftKings reported 3.6M MUPs in Q3 2025 [2]. FanDuel is estimated to have 4.3M MUPs based on tracking data that consistently places it 10–15% higher in user volume [3]. An estimated 40% of users overlap across both platforms, so that is deducted to arrive at 5.9M MUPs. Finally, the analysis adds MUPs from the long tail of competitors (BetMGM, Caesars, etc.) that comprise the remaining 30% of the market [4], resulting in a total of ~8.5M MUPs in 2025.

Notes on perps data:

Monthly Derivatives Volume (CEX): sourced from Binance report

Monthly Perps Volume (DEX): 2025 volume sourced from MEXC report and DeFi Llama, 2024 volume sourced from CoinGecko report and DeFi Llama

Prediction market data sourced from Allium dashboard. Polymarket volumes measure dollar cash flow, while Kalshi’s volumes are reported on a notional basis. There are no per-user numbers available for Kalshi.

Prediction markets do not provide actual vote counts or The Truth; they only provide odds based on bets placed. But they are remarkably accurate, measured by the Brier score, which calculates if Polymarket states that an event is 70% likely to happen, do those events happen 70% of the time? When it states an event is 20% likely to happen, do those events happen 20% of the time? A lower Brier score shows the model is more accurate. Sports betting lines average 0.18-0.22. A Brier score of below 0.125 is good and below 0.1 is great. Polymarket’s is 0.0565, which is excellent.

Equities assets per user for Robinhood is ~25x smaller than Schwab/Fidelity. Interesting...

Please edit your Equities graph, footnote #3: Fidelity and Schwab numbers should be $X Trillion, not Billion, thanks.